“ A successful society is characterised by a rising living standard of its population, increasing investment in factories and basic infrastructure and the generation of additional surplus, which is invested in generating new discoveries in science and technology ” -Robert Trout

Point to Ponder

Buhari’s second tenure is an opportunity to introduce reforms that can stimulate real economic growth by attracting investors from outside.

When President Muhammadu Buhari (PMB) was elected president in 2015, many Nigerians had high hopes for his government. This was because he was an ex-army man (he was a military man during Buhari 1.0). The reality however was that, Buhari was mostly distant in his running of the nation ( he sick for a long time. Some even speculate he died and was replaced by a “clone”). Now that Buhari has won the 2019 elections and seems likely to remain in power (the nominee of the PDP is taken him to court and accused him of fraud), one of the questions to be asked is; under Buhari’s final regime, can Nigeria become more attractive to investors despite its many economic challenges?

The key assumption considered here is that the hardships faced by oil producing countries adjusting to low oil prices was felt generally i.e. it was not particular to Nigeria. To understand this means wrapping your head around the idea that APC’s (Buhari’s party) regime was not the deciding factor in how the economy performed. So therefore, even if the PDP (APC’s main opposition party) won the 2015 election, the occurrences of the economy over the past four years would have largely remained the same.

here are the key happenings over the past four years:

- The challenge of the oil market; Buhari’s regime was characterised by challenges in the oil market as a result of lower oil prices

- Vandalism of oil assets in the Niger Delta; PMB initially tried using force to stop militants from vandalising pipelines in the Niger-Delta by sending soldiers to protect the creek to no effect. He eventually got elders in the region to talk to militants, making for a more peaceful end to the saga

- Challenges with foreign exchange (notably the Naira- Dollar peg from 2015 – 2016 for a 16 month period). PMB’s administration floating the naira caused the local currency to immediately plummet to US$1/N282.00 from US$1/N197.00,l. The FX shortage in the market also directly affected local manufacturing companies.

A perceived lack of vision; PMB’s tenure was perceived as having lack of a clear vision for the economy. Even though there was increased borrowing ( used to pay wages) during his tenure, there was a dearth of infrastructural developments. The administation was characterised by high level of debt servicing. (This pales in comparison to the regimes of OBJ and Goodluck which introduced some standout reforms. OBJ introduced reforms such, as the International Monetary Fund (IMF) debt forgiveness, Excess Crude account (ECA), National Penson Commission (Pencom), Information and CDommunication Technology (ICT) while Goodluck notably introduced the sovereign wealth fund).

4. During PMB’s last tenure, the Nigerian economy was perceived by the external investing public as lacking in clear leadership and policies and catalytic reforms

Need to Know

| Low growth rate environment | A market where growth is below its historical trend and potential |

| High yield | High yield investments offer additional income, but high returns go hand in hand with greater risks. |

| Real investment | Real investment is money that is invested in tangible and productive assets such as machinery and plant, as opposed to investment in securities or other financial instruments. |

| Carry trade | A carry trade is a strategy in which an investor borrows money at a low interest rate in order to invest in an asset that is likely to provide a higher return |

| Debt Servicing | The amount of money required to make payments on the principal and interest on outstanding loans, the interest on bonds, or the principal of maturing bonds |

| Policies (Economy) | The Policy is an official public document that is intended to guide future social, physical, environmental and economic growth and development of a region |

| Foreign Direct Investment | An investment made by a firm or individual in one country into business interests located in another country |

Source: Google, The balance, Investopedia

Looking at the Manifesto of PMB, it is safe to say his focus is on social welfare. He plans to introduce a US$500 million innovation fund, focus on Science, Technology, Arts and Mathematics (STEAM), industrial parks, and continue improving Nigeria’s security and anti-graft (anti-corruption) war. He also plans to support economic diversification and the funding of small businesses.

source: CBN

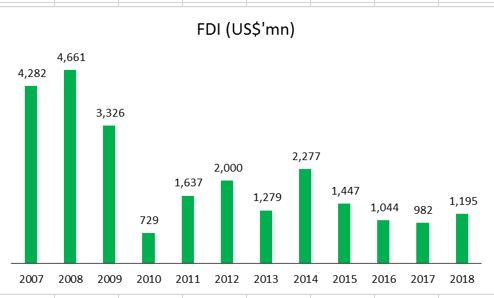

So what can you expect over the next four years? It is safe to say that the most important drivers of investments in Nigeria are policies and reforms. Considering the fact that Nigeria had of late been facing declining rates of FDI and the perception of the country as corrupt (Nigeria Ranks 144/180 On Transparency International’s Corruption Perception Index). Without this key driver in place, expect investors to keep chasing high yield in the form of fixed income instruments.

Looking at Nigeria from the perspective of foreign investors, categorically speaking, Nigeria’s over reliance on its crude oil commodity to support its economy could be one of the key risks to its economic growth. If things remain the same, Nigeria would most likely struggle to attract real investments, as some of the inherent issues discussed above could lead to a general uncertainty about formidable future returns.

In conclusion, continuing at Nigeria’s current level of growth would likely an unfavorable outcome over the four years. An introduction of supportive policies would make make Nigeria more attractive in terms of real investments. It could also successfully attract investments into our equity and fixed income spaces. To prevent this from happening, the Buhari 3.0 has to adopt a more liberal stance towards opening the economy through favorable reforms. Examples of these policies include, those that positive affect Foreign Exchange (FX), infrastructural development, improved access to education, foster public and private partnerships and policies that improve electricity generation and distribution.

Key takeaway:

- If PMB can focus the efforts of his administration on diversifying the economy and fighting corruption, Nigeria should be able to successfully attract investments.

- A failure to attract real investments could support foreign (FDI) investors focused on chasing yields in the fixed income space ( carry trade) frequently coming in and out of the country at will as we have seen in the past

- Real investments are necessary for a stable economy as they attract capital to the country for longer periods