“My mom took her money, she bought me bonds.

That was the sweetest thing of all time “-Jay-z (Legacy)

Last week, I was having a chat with a portfolio manager about investing, when he asked me a really good question: If you had N1bn how would you invest it? I explained to him that I would be interested in exploring venture capital opportunities by providing capital to start-up companies. I also mentioned that I would invest in the US tech stocks because of my interest in that sector, and take position in companies within the sector that I believed in. I spoke about Alphabet (Google), and its long-term potential, as well as fundamentally sound Nigerian stocks I would like to own. He listened to me and nodded in agreement. He waited for me to finish speaking, before asking me another question: What about bonds? I mumbled something along the lines of working with a financial advisor to calculate the riskiness of my investment strategy, but he could tell from my response that I hadn’t giving bonds much thought. He then explained how it was necessary to mitigate various risks such as interest rate risk, market risk, inflation risk and credit risk by considering fixed income instruments (e.g. bonds). Apart from My obvious affinity for venture capital and equity investments, I learnt two main things from this exchange. 1. The importance of building a balanced portfolio (for my N1bn that is coming my way), and 2. embracing fixed income instruments. Therefore, a good place to start is by getting familiar with bond investing.

What do bonds do?

According to ‘Fixed Income: A Beginner’s Guide’ by Fidelity Investments, bonds represent a loan that has been turned into a security which can be traded. A government or corporation borrows money from investors and issues bonds in return. The bonds represent a commitment by the issuer to repay the amount back at some point in the future, usually with interest. A bond issuer offers investors a rate of return in exchange for their initial investment. Bond investors compare the potential for gain with the risk that the issuers will not pay them back at the level described in the bond’s terms of contract.” It’s worth noting that while stocks (equity) provide the investor an ownership in the business, bonds are a form of long-term debt which the issuing corporation promises to pay what is owed to the investor at a specific date.

Source: How Money Works

So here is a simple example of how a bond investment works:

If Folake was to buy a bond now with a face value of N10,000, a coupon rate of 10% and a maturity of 5 years, it means she will receive 10% of N10,000 (N1,000) every year for 5 years, and in the 5th year (the year the loan matures) she would receive her initial N10,000 back. In this example, the face value represents the original price of the bond (N10, 000), the coupon rate is the rate of interest the investor will receive from the issuer (10%), and the maturity refers to the time after the principal will be repaid to the investor (5 years).

What are the types of bonds?

In Nigeria, we have the Sovereign bond (such as Federal Government of Nigeria (FGN) bonds), State and Local Government Council bonds (also known as Sub-National bonds), Government Agency bond, and Corporate bonds. Most FGN bonds have fixed interest rates which are paid semi-annually, while some FGN bonds have floating rates of interest which fluctuate. Although bonds have a minimum tenor of 2 years, they have maturities of 3, 5, 7 and 10 years. (in developed markets there are also bonds with maturities of 15, 20, 30 years or more)

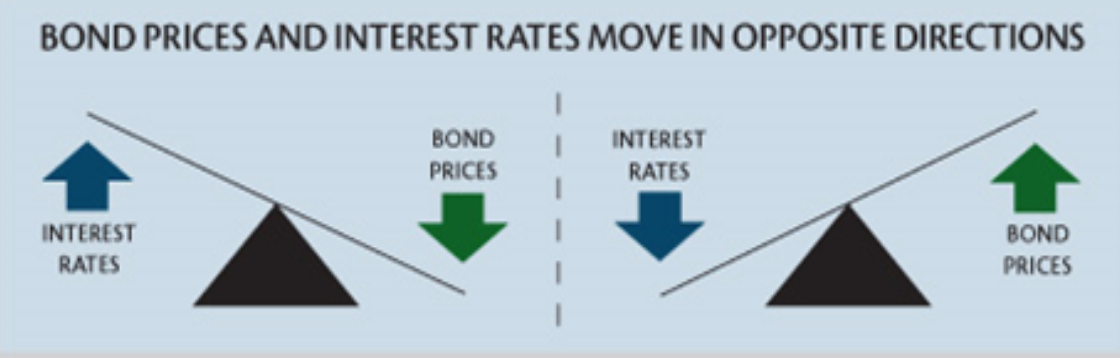

What is the relationship between bonds and interest rates?

The price of a bond goes down when interest rates rise because the interest rate at which the bond was agreed upon is fixed and cannot compete with the newly issued bonds at higher rates. Investors constantly compare the returns on their current investments to what they could get elsewhere in the market. As market interest rates change, a bond’s coupon rate ( a fixed rate) becomes more or less attractive to investors, who are therefore willing to pay more or less for the bond itself.

Are bonds better than equities?

Historically, stocks have produced greater returns than bonds. From an investing standpoint, the best answer is isn’t either stocks or bonds, but usually a combination of stocks and bonds to build a better investment portfolio. Generally, as one gets older and becomes more dependent on savings and investments to fund his/her life, he/she will move further toward less risky investments. This means more of one’s investment portfolio will be focused on investments like bonds.

Whats next?

Once you have a firm grasp on bond investing ( the key terms, the risks associated , and the ability to explain the asset to someone else) , it is time to explore the world of fixed income instruments such as commercial papers, treasury bills, and certificate of deposits. Finally, here are 3 tips for investing in bonds that all new investors can find beneficial:

- INVEST IN LONG TERM BONDS WHEN INTEREST RATES ARE HIGH-When interest rates are high, you can venture into the fixed-income market. Lock your money in long term or medium term bonds. Besides getting good regular income, your investment appreciates when the interest market goes down

- Remember the general rule when buying bonds-LOWER RATING MEANS HIGHER RISK AND SO HIGHER RETURNS

- PREFER BONDS WITH HIGH RATINGS- Buy only investment grade bonds having ratings from Aaa/AAA to Baa/BBB. Avoid high-yield bonds or junk bonds that promise high return as you may lose capital

Digging deeper:

- The Debt Management Office (DMO) of Nigeria website: http://www.dmo.gov.ng/fgn-bonds

- What are the biggest risks of fixed-income investing?

- Are Bonds Safer Than Stocks?

https://www.thebalance.com/are-bonds-safer-than-stocks-357382

- Fixed Income: A Beginner’s Guide: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/FixedIncome_BeginnerGuide_Webinar.pdf

Akinfemi Onadele