“ It all comes down to interest rates. As an investor, all you’re doing is putting up a lump-sump payment for a future cash flow “ -Ray Dalio

One of the most interesting stories about my great grandmother was how she lost all her hard earned money. She made her money from selling “eko” (corn meal) in the market ( I hear it was really good). The stroy goes that great grandma was not very trusting of banks. She resorted to storing the money under her bed. After many years had passed, she found out a painful truth. Her money had lost all its value. Essentially, she had missed out on receiving interest on her money by lending it to the bank . Furthermore, the unit of currencies in her possession had also been removed from circulation as a result of devaluation. This brings us to the topic of interest rates.

An interest rate is effectively the price charged by a lender to a borrower for the use of funds i.e it is effectively the price of using money. The monetary policy rate (MPR) set by the Central Bank of Nigeria (CBN) affects how easy it is to borrow or lend money in a country. All this is important because of the time value of money (TVM). TVM suggests that a year from now (the future) N100 will buy you less, than it can in the present. This idea is the foundation on which interest rates exist.

Using the monetary policy tools at its disposal, The CBN controls the rates commercial banks are borrowing money to stabilise the economy. Lower interest rates make it cheaper to take out loans, and hence to spend more money. In a lower interest rates environment, saving becomes less attractive as interest rates are low. With more money in circulation, expect demand for products and services to rise, thereby stimulating businesses and increasing employment in the economy. ( let’s call this scenario 1)

On the other hand, higher interest rates make loans less affordable, while high interest on savings accounts encourages saving rather than spending. As spending slows, so does the economy, with demand for goods and services decreasing (this includes demand for investment products). In this environment, expect to see a slowdown in businesses and employment levels. (scenario 2)

Need to know

| Real rate | This rate takes inflation into account (calculated by subtracting the inflation rate from the nominal rate) |

| Nominal rate | This interest rate does not factor in the effect of inflation (or fees, or the effect of compound interest) |

| Price stability | A goal of monetary and fiscal policy aiming to support sustainable rates of economic activity |

| Risk-free rate | The risk-free rate is the rate of return of an investment with no risk of loss |

Every time the interest rate is changed, it sends a signal to society that it’s time to either spend or save. This signal may also increase or decrease confidence in the state of the economy.

If interest rates fluctuate all the time, the economy would become volatile (unpredictable changes in price levels). This is why the government and CBN work together to keep inflation and interest at stable rates.

What does this mean for investors? As an investor, your primary goal is to protect your principal invested. To do this well, one must know what the interest rate trend of the economy looks like. This is achieved by keeping tabs on how various asset classes are performing and expectations surrounding them in relation to macroeconomic conditions. The investor must consider the opportunity cost of his money after considering his needs, and the current and future economic environment. As stated in previous posts, the investor should take time to understand the asset class he or she chooses to invest in. This includes an understanding of the asset(s) behavior in various economic cycles and the risks associated with investing. What the investor will find is that there are always opportunities to invest wisely no matter the economic situation at hand. The key here is to have a good perspective about where the economy is going.

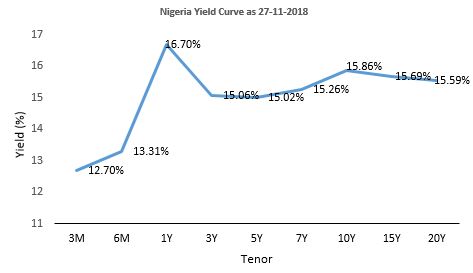

Chart 1: Illustration of interest rates for various fixed income instruments (yield curve) Source: Bloomberg

Last week, as many expected, the MPC of the central bank chose to maintain rates in the short term (the CBN left its benchmark interest rate (MPR) unchanged at 14%). It’s worth noting that last time policy-makers changed rates was in July 2016, when they lifted the monetary rate by 200 bps. Interest Rate in Nigeria averaged 10.90% from 2007 until 2018, reaching an all time high of 14% in July of 2016 and a record low of 6% in July of 2009.

How does this affect Nigerian investors? In the medium-to-long term, it is widely expected that the MPC will look towards tightening the MPR post Nigerian elections in 2019. This in turn will lead banks to demand lower interest rates, thereby encouraging spending in the economy ( see scenario 1 above).

The final word:

Learn from great grandma. Don’t let the time value of money ( and fear) erode the value of your money. Become aware of trends in interest rate and inflation, to make better investing decisions. In summary, develop, a good perspective about where the economy is going.

Key takeaways

- Interest rates are the price of using money. It considers expectations surrounding how the economy will perform, and the risks associated with the future

- The monetary policy rate (MPR) set by the CBN is a tool it uses to control how much money is circulating within the economy at any given time

- Have a look at Nigeria’s yield curve (see chart 1) to get an idea of the interest rates for various tenored instruments

- In 2019, look to reallocate your portfolio to make better returns for the expected macroeconomic environment

- An investor should care about interest rate movements because knowing the interest rate helps the investor understand the opportunity cost of his or her money within a given period