Point to ponder:

Opportunity cost requires one to choose where to allocate capital for a better return on investment

If you loan your friend N100,000 for 1 year at a 5% interest rate, you would be repaid N105,000 at the end of the loan term. According to this example, N100,000 today is worth N105,000 a year from today (calculation: N100,000 x 1.05=N105,000=). Likewise, N100,000 today, discounted back (at 5%) by one year was worth N95,238.09 ( calculation: N100,000/1.05)

As an investor, who seeks to get the best returns possible on your investment, you need to think about the ‘opportunity cost’ of not having N100,000 in your pocket today. Consider what returns you could generate if you had N100,000 right now instead of waiting 1 year for N105,000? If other investment opportunities existed where you could reasonably expect higher than 5% annualised return on my money, then taking the N100,000 is not the best option.

For instance, if a commercial paper is offering me a 15% return for N100,000 in one years time (N115,000 in one years time). That’s higher than the N105,000 your friend offered to pay you in 1 year. In this scenario it is better to decline your friends offer and take up the commercial paper.

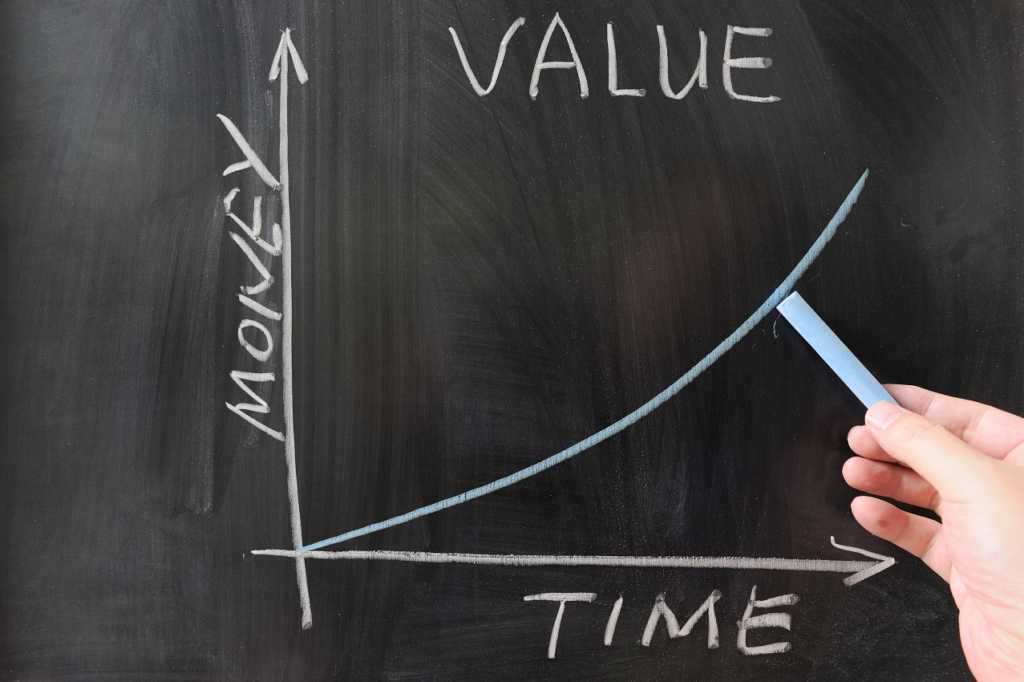

What is the time value of money and why does it matter? The underlying assumption of future value is the concept behind the time value of money. This concept says that ‘money today is worth more than money tomorrow,’. This basically means that money that is available now is worth more than the same amount in the future ( i.e N100,000 today is worth more than N100,000 tomorrow). The logic behind this principle is that money has the potential to grow over a given period of time.

Need to Know

| Time Value of Money | The concept that money available at the present time is worth more than the identical sum in the future due to its potential earning capacity. |

| Return on Investment (ROI) | A performance measure used to evaluate the efficiency of an investment or compare the efficiency of a number of different investments |

| Future Value (FV) | The value of a current asset at a specified date in the future based on an assumed rate of growth |

| Interest rate | Interest calculated on the initial principal, which also includes all of the accumulated interest of previous periods of a deposit or loan |

| Growth rate | Refers to the percentage change of a specific variable within a specific time period |

| Discount rate | The minimum interest rate set by the US Federal Reserve (and some other national banks) for lending to other banks |

| Opportunity cost | Alternative cost of making a particular choice is the value of the most valuable choice out of those that were not taken |

Source : Google

Determine future value so as to plan more intelligently for the future

The folks at omnicalculator.com, explained the importance of future value really well. According to them, “ it’s important to know how to calculate future value if you’re a business owner, or indeed any owner of appreciable assets. Once you know how valuable your assets currently are, it’s important to know how valuable they will be at any given point in the future. That way, you can plan more intelligently for what’s to come.”

How to calculate future cash flow for longer periods

The formula for calculating Future Value is: FV= PV X (1 + R)^N. To successfully determine the future value (FV), you will need the following inputs:

- N= where N is the number of periods/ length of time

- R= where R is the interest rate

- PV= where PV is cash flow at a period

Now let’s work through an example. Calculate the Future Value of a loan where N=20 years, R= 5%, and PV= N100,000. Putting this into the formula, we would have: FV= N100,000 X (1 +0.05)∧20 =N265,329.77 (or just use this instead). therefore, after 20 years N100,000 will have compounded to N265,329.77.

In conclusion, some things grow and appreciate in value over time, while others depreciate over time. Thinking like this, helps you look at time as a resource that has value, as such it can be invested wisely or poorly. It’s important to use a future value calculator in order to get around the problem of the fluctuating value of money. Ultimately, money is our way to assign a number to value. That’s why understanding how to calculate the core value of assets, in the present and in the future, is so crucial.

Key takeaways:

- The Time Value of Money (TVM) helps us understand how to calculate the core value of assets, in the present and in the future

- Put your money to good use by finding the best rates of return, however be wary of the risk involved with making the investment

- Future Value (FV) calculator: You can use this free tool to calculate FV.

- Use the FV formula: FV= PV X (1 + R)^N, to determine how valuable your assets will be in the future

Digging deeper:

Watch this 80 second video illustrating TVM. It shows you how 2 employees of the same company utilised the same amount of bonus they received. Click here