Point to ponder:

If you find you have a certain sum of money that you do not immediately need, you may choose to invest those funds temporarily in money market instruments until you need them.

The Central Bank of Nigeria released its T-bills calendar for the second quarter of 2019 last week (5th of March 2019). The bank seeks to raise over N1 trillion naira during the period. Bayo has N1 million naira he plans to use to fund his trip to South Africa in August. He decides to use the money for his holiday to invest in the money market. Bayo buys N700,000 naira worth of 91-day T-bill offering at the primary market auction. He then saves the remaining N300,000 naira in his money market mutual fund account of his bank, instead of keeping it in a regular savings account.

The benefit Bayo stands to gain is that he can make considerably good returns on his capital in the short term, while having quick access to his money when he needs it for his trip.

Banks and other investors with liquid assets gain a return on their cash or loans through access to the money market. Participants can lend and borrow large sums of money for a period of one year or less. The central bank raises money to finance its operation by issuing T-bills in the money market. In a similar fashion, companies offer commercial papers (CP’s) in the money market. The money raised from the CP’s by these companies are then used to manage the day to day operations of their businesses in the short term. Note however that T-bills issued by the government are risk free and will be repaid while CP’s are considered riskier. Also, money market funds make it easier to access a CP because the minimum subscription amount required to buy into a CP is usually high.

Need to Know

| Money Market | Where financial instruments with high liquidity and very short maturities are traded |

| Money Market instruments | The short-term debts and securities sold on the money markets |

| Money Market Accounts | An interest-bearing account that typically pays a higher interest rate than a savings account |

| Treasury bills (T-bills) | Short-term government securities that mature within three months to one year of issue, also known as T-bills. They are acquired at a discount on their face or “par” value |

| Commercial papers (CP’s) | Short-term debt issued by a company. Only companies with good credit ratings issue commercial paper because investors |

Source: How money works

Advantages of investing in the money market include:

- It’s a great place to park your money for the short term. When the stock market is extremely volatile and investors aren’t sure where to invest their money, the money market can be a terrific safe haven. This is because money market accounts and funds are often considered to have less risk than their stock and bond counterparts.

- Investors can buy and sell them with comparative ease, so there’s no issue with Liquidity

Correspondingly, some of the downsides of money market instruments include:

- Purchasing power of your money can suffer. If inflation is higher than the returns being generated in the money market.

- Investing in Treasury bills is a low yield investment.

- Commercial papers are available only to a few selected blue chip and profitable companies. Because CP’s are issued by large institutions, the denominations (the lowest typically around N5 million naira) of the commercial paper offerings are substantial,

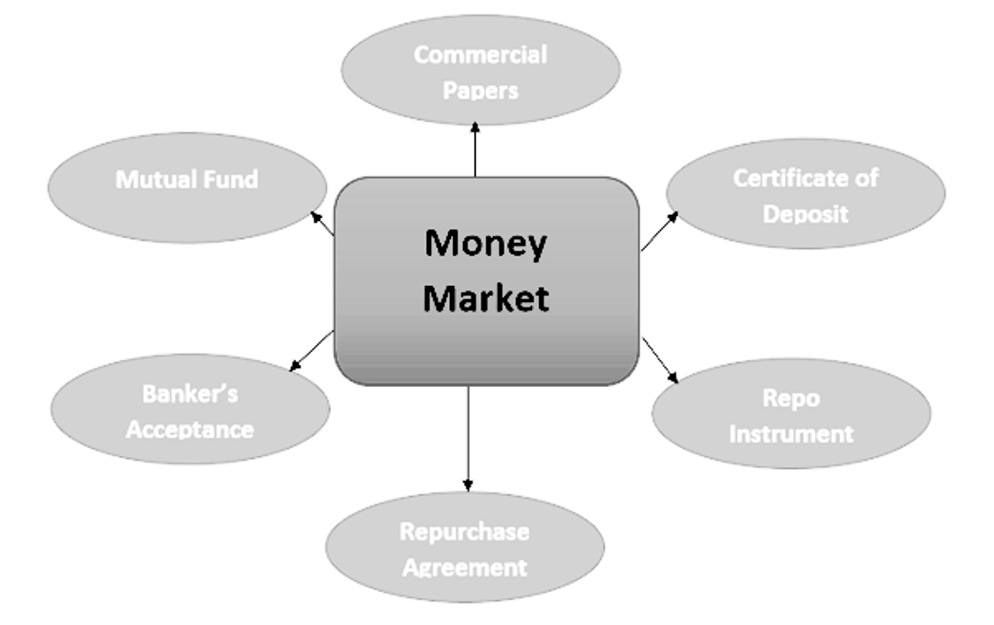

A variety of financial instruments (e.g. certificate of deposits, high interest savings accounts, money market mutual funds, treasury bills, commercial paper, certificate of deposits, bankers’ acceptances etc) have been created for the purposes of short-term lending and borrowing in the money market. If you find you have a certain sum of money that you do not immediately need, you may choose to invest those funds temporarily in money market instrument until you need them.

Last but not least, a word of caution. Investopedia states that “Over time, money market investing can actually make a person poorer in the sense that the dollars (or naira) they earn may not keep pace with the rising cost of living.” That being said, it will be a poor decision not to allocate capital to more long term investments.

Key takeaways:

- Money market investing can be very advantageous if you need a short-term place to park cash. Beware of the possibility of low returns and a loss of purchasing power due to high inflation

Dig Deeper:

Start using money markets today. Click here to see the daily rates for money market funds in Nigeria, courtesy of the Fund Managers Association of Nigeria (FMAN) (phone numbers for various funds are also included).