Source: NSE, Bloomberg.com

Source: NSE, Bloomberg.com

Point to Ponder:

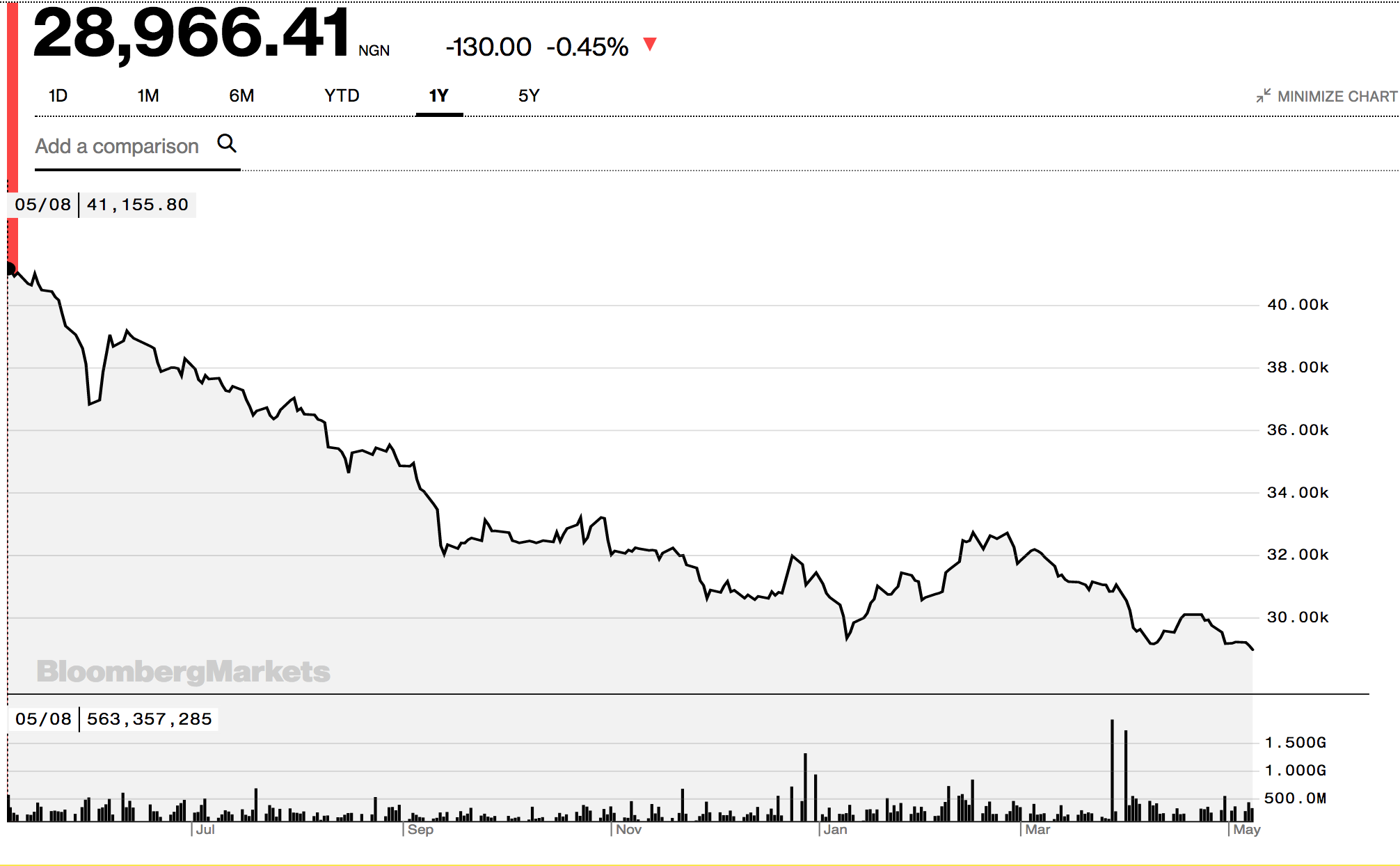

The Nigerian stock market is down despite the strong macroeconomic fundamentals

First quarter 2019 earnings releases have come and gone, and the Nigeria’s stock market is still down ( 28,966.41 points; -7.84% Year To Date return (as of 8th of May 2019)). So what is going on ? What happened to the expected rally once the president gets confirmed?

It seems like the absence of economic triggers post-election as well as the lackluster Q1-19 earnings releases by some companies have failed to life the market. Furthermore, foreign portfolio investors (FPIs) who have historically influenced the pace of trading within the market have sat on the sidelines.

Considering all other economic fundamentals are favorable, my guess is that you should expect to see a rebound in the market once the President has chosen his cabinet. The President’s choice of cabinet would indicate the countries direction from a policy standpoint.

Introducing favorable policies will serve (the lack of policies was a major criticism of the governments’ last tenure) as a catalyst for growth within the Nigerian economy. Once there’s more clarity around this, the market should swing back into the positive region. So don’t fret dear equity investors, Nigeria remains an attractive market for investors in in the short to medium term.

Need to Know

| Year To Date (YTD) return | YTD return refers to the amount of profit made by an investment since the first day of the calendar year. Investors and analysts use YTD returns to assess the performance of investments and portfolios. |

| Foreign Portfolio Investors (FPI) | Foreign investors deposit money in a country’s bank or make purchases in the country’s stock and bond markets, sometimes for speculation. |

| Macroeconomic fundamentals | Macroeconomic fundamentals are topics that affect an economy at-large, including statistics regarding unemployment, supply and demand, growth, and inflation, as well as considerations for monetary or fiscal policy and international trade. |

| Stock market rebound | In financial terms, a stock market rebound means the stock market recovers from prior negative activity. |

Source: Google, Investopedia