Point to ponder:

You can improve your chances of financial success when you direct all of your energy and attention to fewer investments

The ’20 -slot rule’ is a concept that has been made popular by none other than Warren Buffett. Buffett is undoubtedly one of the best investors the world has ever seen. His business acumen and investments ( his company Berkshire Hathaway ,NYSE:BRK-A, has a share price of $309,220.00. Yes that’s the price of owning ONE share in his company). There are literally hundred’s of books that talk about his investments, philosophy, and wisdom. Notwithstanding, the 20-slot rule is a simple way of thinking that the ” Sage of Omaha” (Buffett comes from Omaha, Nebraska) refers to time and time again.

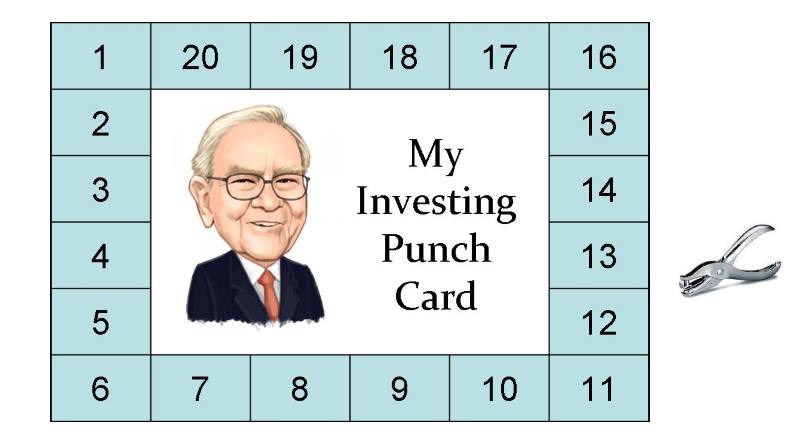

This is how Warren described the 20-slot rule:

“ I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches–representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So you would do so much better.”

True to his 20-slot philosophy, his company’s stockpile of cash has grown to more than $111 billion (as at August 2018). This is money Buffett clearly does not feel any pressure to use. He will simply wait until the right investments present themselves before allocating some capital towards them.

Why you should apply his advice:

Apart from obvious reasons ( i.e. being one of the richest men in history) , It’s the level of thought that needs to go into these 20 investments that you make over your lifetime that makes this a valuable approach to investing. Think about it. If you could only invest in 20 or so different situations over the course of your life, will you go off the advice of a journalist in a newspaper, or a stock tip you heard on the radio? I hope not. You will most likely spend vast amounts of time thinking about various investment opportunities in front of you, and take time to understand the investments.

So how should you think about these investments before allocating capital towards them? Warren Buffett provides further advice thats very helpful here. He suggests that successful investing is mainly 4 things:

1. The investment should be one that you understand completely. Be able to understand what the business does, the economics of the business, and the industry. Like I’ve said in the past make sure you understand the asset class before investing in it. Be able to talk about the costs and benefits of making the investment, the drivers of growth in the industry, and how the asset performs in various situations.

2. The company should have favorable long-term economics i.e. the investment should have an economic moat (another concept popularised by Warren. Also known as the competitive advantage of a business). If you choose to invest in a business, the moat allows the company achieve high returns year after year.

3. The company’s management should be able and trustworthy. Management of the company should be be competent and honest if the people in charge of the company do not care about maximising shareholder value for the long term while managing resources efficiently, they will steer the company in the wrong direction.

4. The investment should be one that you can purchase at a reasonable price. As Warren says, “Price is what we pay. Value is what we get.” Spend some time assessing the value of a stock. Once you determine the value of the security ( i.e whether the price of the stock is overvalued or undervalued), the price you pay for the security should be lower than the assessed price of the security (basically, if its overvalued, do not buy, and if its trading at a discount (i.e. undervalued) buy).

The Nigerian stock market (NSE ASI) is currently making a rebound ( year to date it has risen to +3.77% (as at 20th of February 2019). Last year it closed at -17.8%). This presents opportunities for investors to take advantage of cheap valuations across quality names available in the market. My challenge to you is to use the 20-slot rule to decide which investments to make right now. For instance, Don’t just buy the security because its cheap. Dig deeper with the advice of Warren to make worthwhile investments based on sound research.

My challenge to you

- Use the 20 slot rule to decide which investment(s) to make right now