“ Domestic inflation reflects domestic monetary policy ”- Martin Feldstein

Points to ponder

A dovish tone will lead to lower interest rates and hawkish tone will mean higher interest rates

The Monetary Policy Committee (MPC) meeting will hold today; as such investors, analysts, and commentators alike will talk around the activities of the Central Bank of Nigeria (CBN) going forward. This is mainly to determine the apex bank’s consideration about increasing and cutting monetary policy.

In these discussions about the economy, you will most likely hear the terms hawk and dove being used to describe what commentators believe is on the horizon. These terms are second nature to those who regularly comment on the economy. However, it’s not uncommon for individuals to get confused about the meaning of dovish and hawkish. The purpose of this post is to give you a clear of understanding of these terms and how they relate to the economy. Let’s start with therm term Dovish.

What does dovish mean?

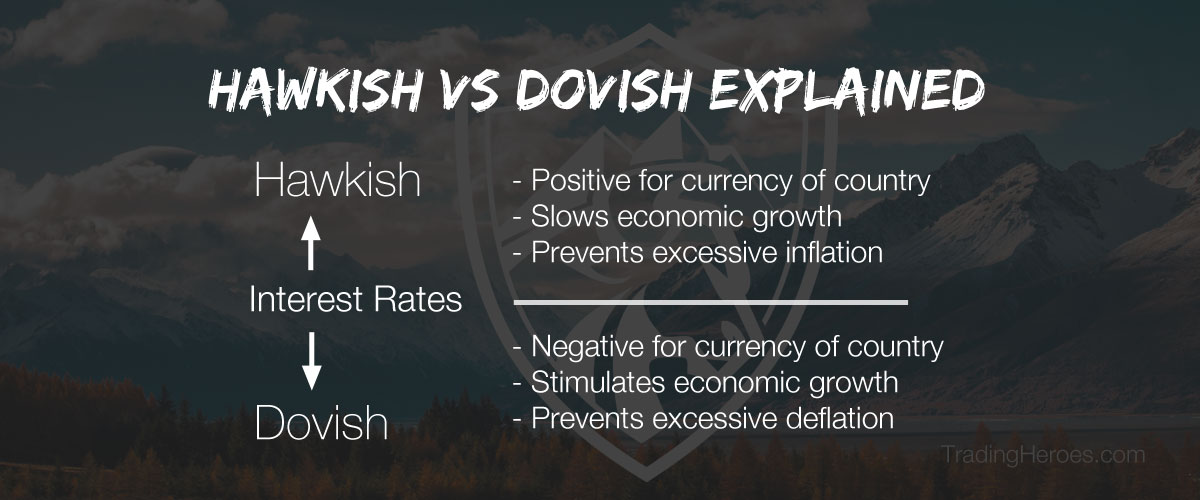

A dovish tone from the central bank will lead to lower interest rates (or an equivalent action) and a possible weakening of the country’s currency.

lets examine the following statement: “Buying sentiment towards the Naira deteriorated sharply yesterday, after dovish comments from CBN Governor Godwin Emefiele heavily diluted expectations of an interest rate hike in May.” The dovish sentiments referred to in here means the central bank may want to do something to stimulate the economy. In order for people to start spending more money on goods and services, the central bank will usually lower interest rates.

Now what about a hawkish tone?

A hawkish tone communicates the fact that interest rates need to rise. Examine thie following statement: “ Mr Emefiele’s “hawkishness” will help shore up faith in Africa’s largest economy, where criticism has been strongest of the emergency action taken concerning Nigeria’s monetary system”. What a statement like this alludes to is that the central bank wants to guard against excessive inflation.

Need to Know:

| Stimulate the economy |

Use of monetary or fiscal policy changes to kickstart growth during a recession. Governments can accomplish this by using tactics such as lowering interest rates |

| Fed tools | The Fed can use four tools to achieve its monetary policy goals: the discount rate, reserve requirements, open market operations, and interest on reserves. All four affect the amount of funds in the banking system. |

| Dovish tone | loosening monetary policy. ( kind and soft like a dove), policy will have a minimum impact, the risk is that if kept low for a period of time, inflation will set in, |

| Hawkish tone | Potential increase in interest rates, tightening, (aggressive like a hawk) |

| Inflation | General increase in prices and fall in the purchasing value of money. |

Source: Google

The tone of the central bank is key to investment decisions, and that’s why a lot of time is spent analysing the comments made by the MPC. These comments essentially determine the direction of economic activity in a country going forward; i.e. from interest rates, to currency stability, employment, and so on. (see image below).

Now here’s a challenge for you: Look out for the comments of the CBN governor from today’s MPC meeting to determine if the CBN has a hawkish or dovish tone. Discuss with someone about what you think the direction of the central bank is concerning rates (and why).

Key Takeaway

Source: https://www.tradingheroes.com/hawkish-and-dovish/