“Change is the only constant thing in life”

What is a Theory of Change? Simply put, a Theory of Change (TOC) explains the pathway to achieving long-term goals. It provides a visual or narrative explanation about what we want to ultimately achieve, and how we plan to achieve it. This process allows for clarity about what one must do to achieve a long term goal . The user of the TOC engages in backwards planning to identify the requirements necessary to achieve this goal.

As an example of TOC, let us illustrate with Tobi who whats to get better at managing his finances.

Tobi is 25 years old male living in Lagos, Nigeria. He recently had a conversation with his mentor who recommended the personal finance classic “Your money or your life” by Joe Dominguez and Vicki Robbins. Upon completion of the book, Tobi assessed himself to have poor money habits. According to his estimates, he had spent approximately N19 millon naira in the past seven years with only little to show in terms of assets, savings, and investments.

A newly motivated Tobi, sets a new goal to achieve financial freedom by the age of 35. A goal which he plans to achieve by saving more, spending less, investing, and keeping better financial records. Tobi’s theory of change to achieve financial Tobi’s goal is: I can achieve financial freedom if I save more, invest more, spend less, and keep better financial records by the age of 35.

Tobi decided to use the Theory of Change concept for better money management

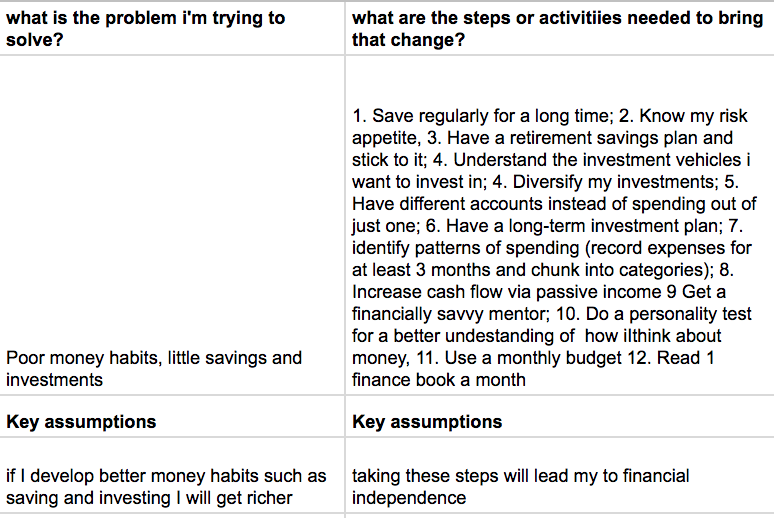

Table 1: Tobi’s answers to Theory of Change questions

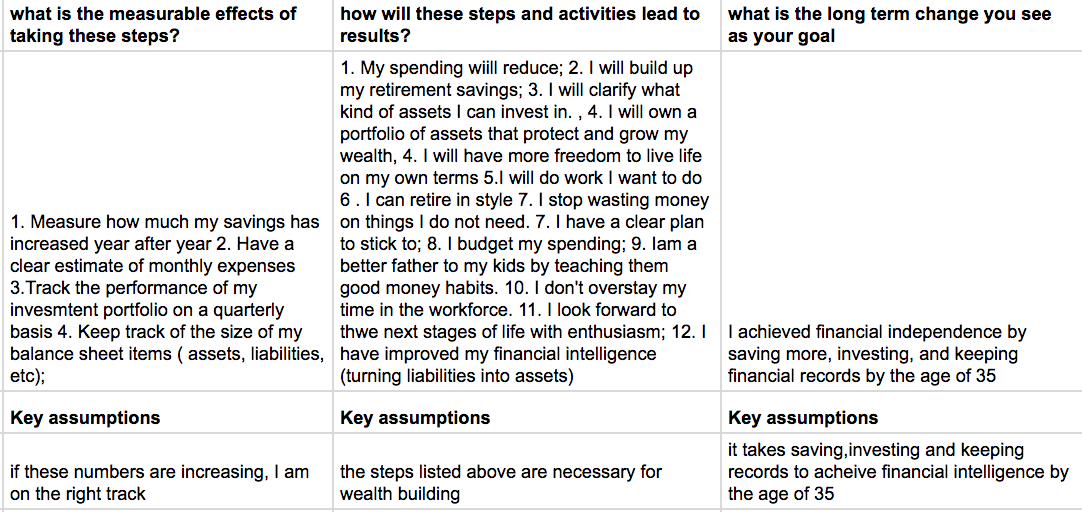

Table 2: Tobi’s answers to Theory of Change questions

Tobi completes his TOC and takes it to his next meeting with his mentor. Together, they analyse his processes and and the impending risks to this process. His mentor explains the importance of a time horizon and risk tolerance when it comes to investing. He also shared statistics of how investment goals change as one gets older (considering factors such as family increasing, lifestyle changes, insurance etc).

Finally, Tobi’s mentor gives him homework to go and think about the effort required to commit to each step for the achievement of his final goal of financial freedom.

How will these steps affect the normal way Tobi conducts his affairs? What contingency plans needs to be in place to mitigate risks of complacency in his efforts? All in all, his mentor is happy that Tobi is off to a good start. They both end the meeting to out for a cup of coffee.

Now let’s consider the alternative. Instead of using the TOC Tobi, identifies that he needs to get better with money, and sets it as a goal to develop money habits (without establishing a theory of change process). If Tobi used this method he could miss the chance to identify clear steps, priorities, identify his assumptions ( and how long it will take to complete various steps), and miss out on useful indicators of whether he is indeed on the right track. He will miss the opportunity to test his logic (walking back from the intended goal to the present problem (poor money habits) he is trying to solve.

Using the TOC before starting the pursuit of long-term goals can provide invaluable insight into our assumptions or ideas as to how the desired change will occur. What’s more, running them by a team of experienced people will strengthen the plan for the better and make it executable.

Akinfemi Onadele