” Anchored-to-your-own-history bias: Your personal experiences make up maybe 0.00000001% of what’s happened in the world but maybe 80% of how you think the world works” – Morgan Housel

Imagine this scenario: you inherit a Ben Enwonwu painting from your grandfather. Attached to the painting was a handwritten note saying its worth N5 million naira. After a little while, you find yourself in a tight spot, and decide to sell the painting for cash. A collector offers you N1 million for the piece—and you turn it down immediately.

After that a museum calls and makes you an offer of N6.3 million naira for the painting which you happily took. Not long after, you discover that the painting is worth at least N12.5 million naira. How would you feel? Its safe to say you will feel very bad for leaving money in the table. Instead of you feeling like you’d made a profit, you’d feel foolish knowing there was an opportunity to earn way more.

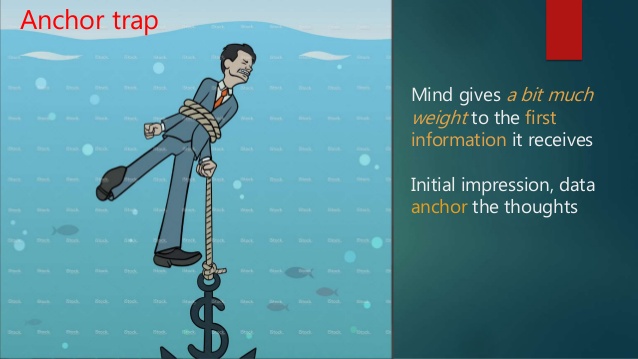

This is an example of a psychological trap known as anchoring bias. Anchoring bias occurs when an individual gives more weigh to the initial piece of information (the anchor) in coming to his or decision as to which action to take.

Why does anchoring bias happen?

“What if I don’t anchor? I’m intelligent!” I agree! You are intelligent. However, the correct response to this assertion is that as a result of how the human mind works, we are prone to anchoring. The human brain is naturally conditioned to form estimates. When you think about it, it’s pretty hard to decide something without estimates (or a comparison) about its worth. Anchoring is mainly caused by uncertainties. In the face of uncertainty, it is normal for one to determine value based on historical information.

What does it look like in investing decisions?

In one instance an investor can hold on too long to the investments that have lost value. In addition to this, the anchoring bias can also make the investors make less than ideal financial decisions, ignoring an undervalued investment or holding the overvalued investment for too long. One of the most common anchor traps in investing is past events and trends. Investors may become anchored to historical values of a particular stock and base decisions as to whether or not to invest in a stock. In this scenario, past figures can give an estimate of historical prices of the stock over a period, but will definitely fail to capture rapid changes in the marketplace should such changes present themselves.

How do you overcome anchoring bias in investing decisions?

The best way to overcome the effects of anchoring is to be aware of it. Awareness is the first step to reducing the impact of anchoring when making decisions. Once you are aware, you can build habits that allow you overcome the bias. Seeing as one is prone to giving disproportionate weight to the initial information one receives, a good way to overcome this bias to examine the decision at hand from various perspectives. According to John. S. Hammond, et al , in the popular article titled “The Hidden Traps in Decision making“, using alternative starting points and approaches rather than sticking with the first line of thought that occurs to you can counter the effect of the anchoring bias.

Moreover, be careful with the advice of journalists, experts, what you heard on TV or on the radio. These various sources may anchor you into the decision you choose to make about an investment. You have to look at the decisions from different perspectives. Conversely, when seeking the advice of others don’t give them too much of your idea, so you just don’t have them confirming what you already believe. Let them have a chance to give you their individual opinion. Do this by asking open-ended questions, as opposed to framing your question in such a way that makes them agree with your initial opinion.

By the same token, don’t buy stock because your friend told made money buying some. If you choose to, you are failing to ignore other key pieces of information (fundamentals) necessary for making sound investing decisions. You may be choosing to ignore better returns in other asset classes, the intrinsic value of the asset, and changing market dynamics that could quickly turn from sweet to sour.

Going back to the first scenario, you could have made more money on the wonderful painting grandpa left you if;

i. you considered the costs and benefits of selling the painting at this time; ii.s you pent some more time talking to other art professionals to ascertain the value of the piece; iii. read more about the artist (and his influence) to improve your bargaining power and iv. shopped around for better prices.

The key here is to embrace the uncertainty by creating various alternatives that will prevent you from making a mistake on the pricing.

For these reasons stated above, it can be summarised that making good investment decisions require rational and logical thinking. When we examine bad decisions, they can usually be traced back to the way the decisions were made. When you fail to identify alternatives, and engage in critical thinking ( i.e. weighing the pros and cons of making a choice) you tend to easily fall prey to this hidden trap in decision making. Your job as an investor is to protect yourself ( and your investments) by making sound decisions.

Key takeaway:

Focus on the fundamentals when investing. Beware of anchors like historical values and valuation multiples. They can be harmful to making right investment decisions. Remember that anchoring exists in every situation where there is uncertainty, so don’t fall prey to its effects so easily.