” Learning does not mean acquiring more information, but expanding the ability to produce the results we truly want in life” – Peter Senge

“ What else can I do? I’m just useless! ” cries Rita , as she looks through the SMS notification sent from her bank. She looks at her friend who is sitting beside her. ‘ Like What the hell ! I can’t just deal. Where did my money go already? I’m broke and the month literally just started ‘

Both ladies are seated at a table for two in a cafe, where they decided to meet up for lunch.

‘ Please stop being dramatic, we are in public, abeg ’ responds Titi, as she continues to slide down Instagram on her phone, clearly very aware of her dear friend’s over-elaborate antics. After all, they are childhood friends. The waiter drops two cappuccinos in front of the ladies, and then sets the table for the food they ordered. The waiter leaves before the ladies pick up the conversation.

Rita speaks once more ‘ Babe, when I started the year off, I really thought things would be different. Like, I was totally pumped to get on top of my finances- I was ready for my journey towards financial freedom. But the reality is that, I’m unable to get a grip on the flow of money in and out of my life ’. She pauses for a few seconds, sighs deeply, before letting her shoulders drop.

Titi looks at her with empathy. She understands what it’s like to feel you’ve lost control. She holds her friend’s hand, and her gives a soft smile. Titi responds ‘ It’s fine- don’t be so hard on yourself, Rita! May I ask you some questions? ’ said Titi .

‘Sure’ replied Rita.

‘Okay first question- Do you know how much your budget is for your expenses?’

‘Yes. I have a budget. The problem is I can never keep to it.’

‘ Next question: when was the last time you reviewed your finances? ‘

‘ Ummm’. Rita thinks for a few seconds then says. ‘sometime in March this year, or so’

‘Ok cool, next question, Do you have an automated plan for how you save your money? ‘

‘Nope’, Rita responds dryly, rolling her eyes, beginning to get bored from the interrogation

‘What about finance goals?. Do you have any?’

‘ Yes I have one- to be freakin’ wealthy. 100 billion gang’

Haha. Titi gives off a chuckle. ‘ Okay next question- Have you estimated how much you will require if you were to live without a job for the rest of your life?‘

‘Well, I just told you 100 BILLION gang, are you deaf ?” remarked Rita, clearly irritated. ‘Okay I’ve heard enough.’ Rita keeps quiet and sulks

…..

Titi holds her friend’s hand even tighter, gives off a soft smile, then continues to talk. ‘ I’ll let you in on the secret of successful personal finance, my dear ’. If you take this secret and really use it, for sure it will be a game changer for you.’

Rita sits up expectantly.

Titi continues, ‘ successful personal finance is really about self-evaluation. The overall purpose of personal finance is to use your money to optimise your values and priorities- and the more consistent you are at this, the better you control of your financial situation’.

She lets go of her friend’s hand to take a sip of her tea. Before continuing. ‘It’s about regularly assessing where your money is going.’

Why is regular self evaluation of your finances necessary? asks Rita, who isn’t sold on the idea.

Its necessary because where your money actually goes maybe different from where you planned for it to go. For instance, you may require more savings and investments, but most of your money is going towards clothes shopping and eating out. if this occurs, you’ll need to a method to get the flow back on track.

Rita nods her head in agreement.

‘It’s more about getting your mind right than, math and rules’ Titi says. ‘ Personal finance has to do with understanding and managing your behavior; habits, mindset, and ultimately your actions. It’s really journaling at its core ‘

Rita begins to see sense in her friend’s words. After a few seconds of letting this new knowledge sink in, she asks, ‘ How do I go about conducting my personal finance, then? ‘

Titi replies, ‘that’s okay! Those with good money management don’t start off this way. They begin the practice until it becomes a habit. Naturally, we are inclined to procrastinate on saving, eat out too much, pay too much for things, fail to use a budget, fail to prioritise, ignore track their spending, as well as their savings and investments.

‘YUP ! All me’ Rita chirps in. Lets not forget missing monthly payments, buying what you want instead of what you need, keeping up with the Joneses, not learning about money management and impulse purchases? My darling, I’m very familiar with these challenges. I must be the queen of bad money management ’

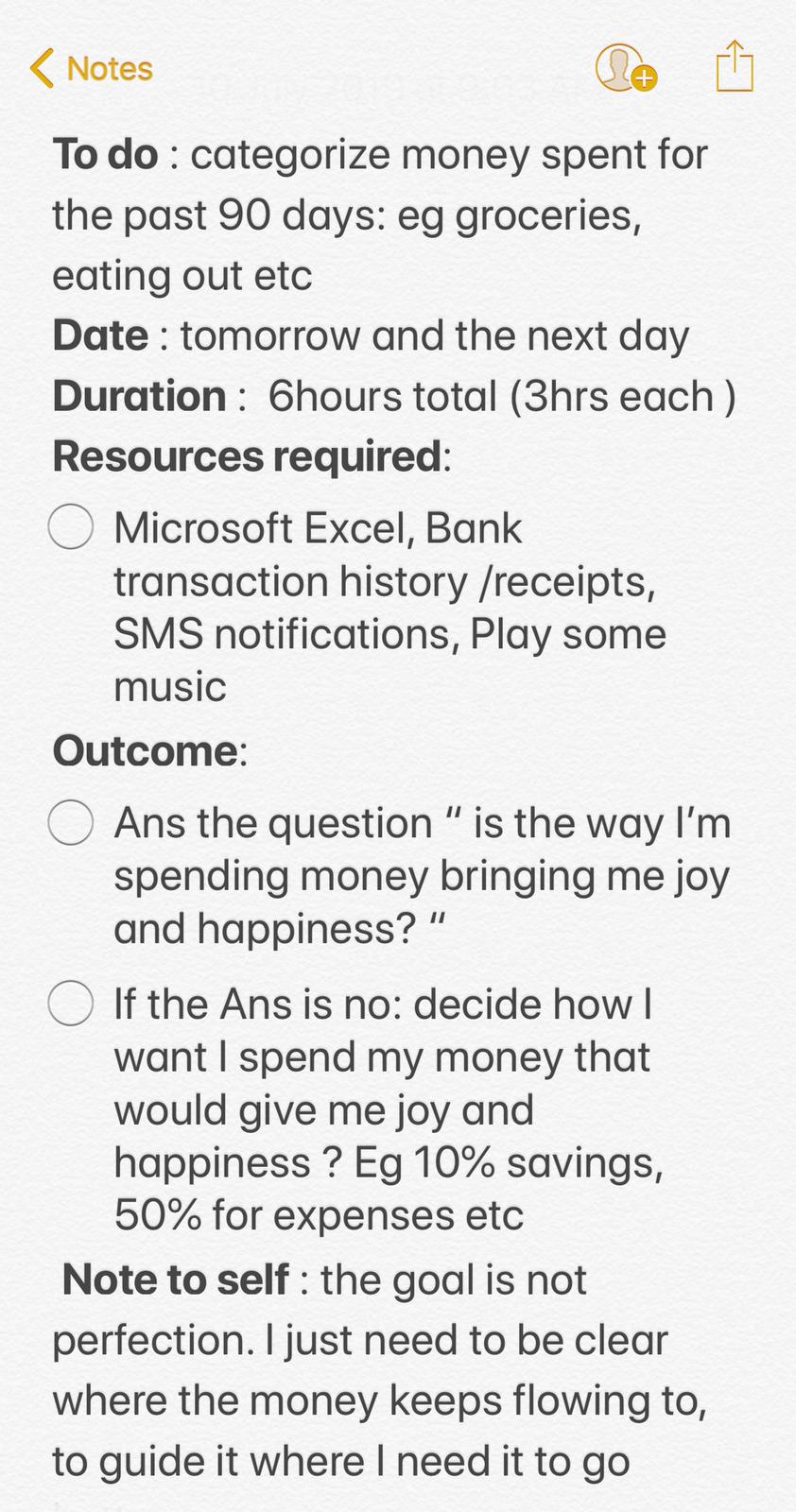

Don’t do that to yourself, Rita , it’s counter productive. ‘ Here’s my suggestion. The first 6 months of the year have just gone, and we are now entering into a new quarter. Over the next few days, block out some time to identify how you spent your money in the previous 90 days. Play your fave playlist on apple music, gather your tools and begin.’

Use your SMS notifications of transaction history ,your bank app and receipts, Open your excel file on your mac, and type each the transactions and label them. Be as specific as possible with the labelling. By this I mean anything you know that occurs regularly should be labelled accordingly-,say if you bought biscuits a lot when you went grocery shopping, label biscuits as its own header. You want to know how much you spend on biscuits and if it makes you happy.’.

“ I see! Okay, she brings out her phone and starts taking notes

“Once you’ve compiled the data, you can begin to ask some questions- based on the figures, does the way you spend your money gives you a feeling of joy and happiness? If the answer is no, then ask, ‘what meaningful changes can you make to move beyond these challenges in your finances ? How would you like the money to flow so it brings you a feeling of joy and happiness? Really consider yourself- What you know without a doubt you will act on. Once you do this you can identify what rules you need to follow to be successful. Get clear about these, As it becomes the anchor of every weekly self evaluation that you perform going forward.

“ I see! This makes a lot of sense o! “

Rita jots all these points down into her phone. She can’t help but notice how motivated she feels to put these ideas to use. ‘TITILAYO! My babe. You too much ! She gives her a friend a high five and continues to ‘ Seriously Titi, thanks a lot. I appreciate this.’

You’re welcome sweetie.’ responds Titi, I know how you feel Rita. Once my boyfriend taught me the habit of evaluating my finances, it really changed my relationship with money for the better. Fast forward it’s been a year, and I don’t run away from my bank balance after I make a payment for something. She giggles, poking fun at her past behavior.’

‘ As much as you sound like such a geek, right now, that was exactly what I needed to hear, geek!’ Rita grins. she feels happier after the guidance from her friend.

‘Yeah whatever, loser’.Says Titi jokingly. Call me geek again, and I won’t send you the excel template you can use to do this exercise’. She continues ‘I like to think about my finances this way- when we were babies, our parents weren’t eager to wake up in the middle of the night and change our diapers- yet they did it. Doing so was more an obligation than an expression of love. I reckon it’s the same with practicing good money habits. You don’t have to love the process of money management, but creating necessity around performing regular financial checkups, will make sure your life is on track.’

Titi lets off a huge sigh of relief then says ‘ Give me feedback next week how it all goes okay? For now, I want us to talk about more important things. Like Big Brother Nigeria and Real Housewives of L.A.’

‘ Sure thing geek.ng ’ says Rita.

They both break into a long laugh before continuing with their date.

The End.

Resource:

If you would like to use Titi’s spending awareness template to get started, click here